Provision relating to Declaration of Dividend. 2 Every director or manager of a company who wilfully pays or permits to be paid any dividend out of what he knows is not profits except pursuant to section 60.

Chapter 5 Non Business Income Students

Dividends are exempt in the hands of shareholders.

. Dividend distribution must be done through PROFITS generated by the company. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. 26 rows Below table shows the upcoming ex and payment date of Malaysia dividend counters.

Malaysia is under the single-tier tax system. There is no legal obligation for dividends to be paid and the right to recommend a dividend lies with the board of directors. 1A-1D Deleted by Act A1081.

The company must be SOLVENT companys asset percentage higher than its liabilities according to Section 131 of Companies Act 2016. Conference of the Fatwa Committee National Council of Islamic Religious Affairs Malaysia held on June 23-25 2009 has resolved that. Right to Recommend the Dividend.

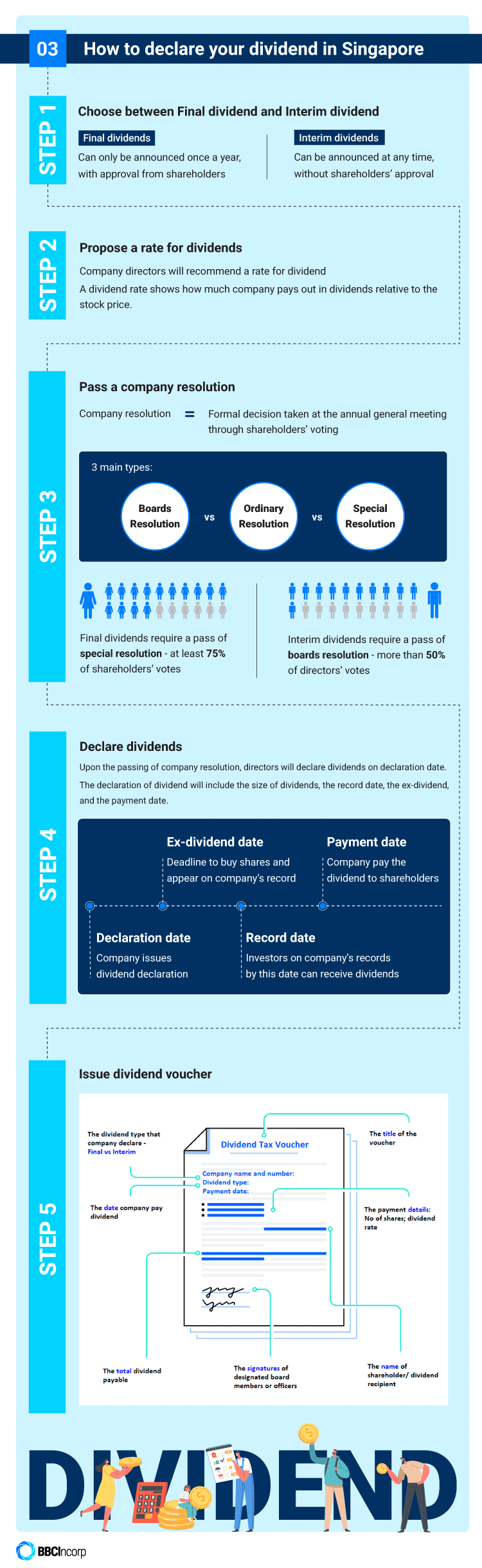

They are summarized below. However section 712 of the Act provides that this right may be negated altered or added to by. Record date is the date by which the investor must be on the companys books in order to receive a dividend.

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. Since the inception of the CA this is the first attempt by the CCM to reform the Malaysian corporate law which governs the distribution of dividends to shareholders.

Ex-dividend date is the deadline by which investors must buy shares to qualify for the dividend payment usually 1-2 days before the record date. Simply put the shareholders do not need to declare or pay tax in lieu of the dividend because it has already been paid for by the company. If and when dividends are declared by the directors the shareholders are by default entitled to the right in an equal share in dividends.

Opening price of the stock on the day the Entitlement was announced. Get this ratio by dividing the companys annual dividend by its stock price. The proposed changes are embodied in Subdivision 6 Clauses 130 to 132 of Division 1 of Part III of the Bill.

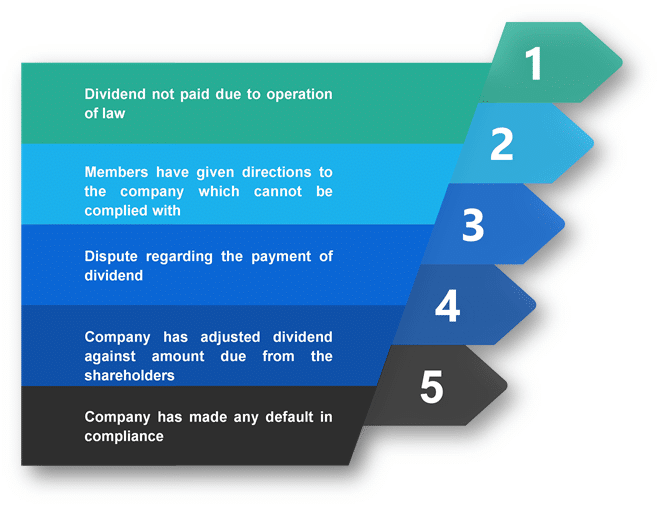

Dividend for Simpanan Shariah and Simpanan Konvensional is difference because the dividend declared will depends on the actual investment performance of the respective funds. When declaring a dividend it is important for the directors. 1 No dividend shall be payable to the shareholders of any company except out of profits or pursuant to section 60.

TAMBUN INDAH LAND BERHAD. Blue counters Ex in coming weeks Red counters Expired. Name Fullname Code EX Date Payment Date DY Yield Link.

1 Click the Stock on table to view the Stocks entitlement page. Current stock price. Bonus Share Split Consolidation.

For example if a stock has a 4 dividend yield and you have bought RM10000 worth of shares youll get RM400 in dividends. Dividends are exempt in the hands of shareholders. While income is taxable in Malaysia capital gains on shares are not subject to tax.

Corporate shareholders receiving exempt single-tier dividends can. The amount of dividend approved by the board cannot be exceeded by the company. For example your company declared.

The right to recommend a dividend lies with the Board of directors. Capital gains tax is only applicable to gains from the sale of real properties or shares in a real. Malaysia is under the single-tier tax system.

Only when the Board recommends a dividend the shareholders can declare a dividend in the general meeting. The new provisions lay down the requirements that have to be met. A dividend is a distribution to the shareholders of the company based on the number and type of shares that they hold.

However the shareholders cannot insist the directors. QUOTE nujikabane Jul 15 2009 0138 PM This is because the company will declare dividend minus the tax and send out the dividends to the shareholders. Section 123 of the Companies Act 2013 provides that dividend should be declared by the company on such rate at its annual general meeting as recommended by the board.

Date of announcement past 3 months Ex Date next 30 days Hints. Interim dividend must be declared out of the surplus in the profit and loss account and out of profits of the financial year in which such interim dividend is sought to be declaredSection 1233. HS Wang Holdings Sdn Bhd v Borneo Pride Sdn Bhd Ors 2017 MLJU 2239 is illustrative of the above principle wherein the Court held as follows.

Rules regarding declaration and payment of dividend. Ensure theres sustainable CASH in-hand and cashflow in the companys bank account. In Islam property acquired.

Whether dividends are distributed and in what amount must be authorized by the directors. Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any profits or gains deriving from any price increase when you sell a stock. Courts are of the view that there is no oppression provided that the managements discretion to declare and distribute dividends is proper and if there is no common understanding to declare dividends.

Payment date is the date on which company pay the dividend to shareholders. The dividend yield shows you how much dividends youll get if you buy a certain amount of the companys stock. 2 Click the View table to view the entitlement detail page.

Dividends Declared Journal Entry Double Entry Bookkeeping

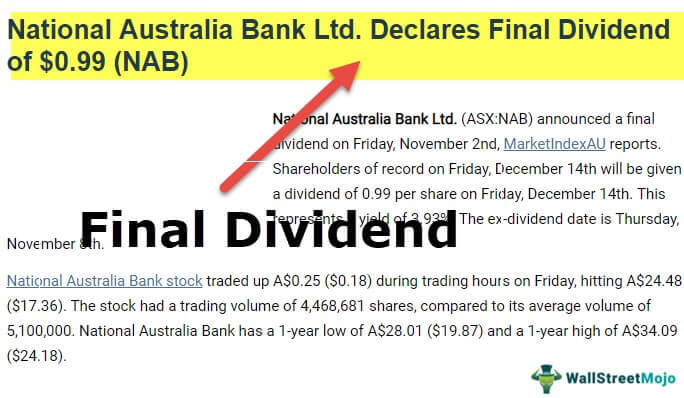

Final Dividend Meaning Example Vs Interim Dividend

Leading Malaysia Estate Planner Can Bring The Best Solutions For You Will And Testament Notary Service Living Trust

Format Of Board Resolution For Recommendation Of Dividend

Declaration And Payment Of Dividend Under Companies Act 2013

Declaration Of Compliance Fresenius Medical Care

Procedure For Declaration And Payment Of Interim Dividend By The Board Of Directors

Dividend Declaration Procedure Surplus Reserves In Case Of Insufficient

Declaration And Payment Of Dividend Under Companies Act Enterslice

Dividend Declaration Rules In Singapore

Declaration Of Interim Dividend By Private Limited Company Indiafilings

Guide To Declaring Dividend In Company

Procedure For Declaration Of Dividend Lawrbit

Declaration And Payment Of Dividend Under Companies Act 2013

Variables Definition And Measurement Dividend Pay Out Rate Dp1 The Download Table

Declare And Pay Dividend In Case Of Loss Or Inadequate Profits

Procedure For Declaration Of Dividend Out Of Reserves Ipleaders

Dividend Declaration Rules In Singapore